Editable 1099

What is Form 1099-MISC. Ad Get A Verified Fast Simple 1099 MISC.

1099 Nec Form 2022 Printable Blank 1099 Nec Template Pdfliner

Quick Secure Online Filing.

. Just Fill Out File Instantly - 100 Free. Tax Forms Made Simple. Edit Create Sign and Share PDFs from Anywhere with Adobe Acrobat Pro.

Print Or Download To PDF Word. Try It Free Today. Ad Edit Create Sign and Share PDFs from Anywhere with Adobe Acrobat Pro.

26 rows Form 1099-INT. There is a rule that you must issue a Form. CORRECTED if checked.

When do you need to send a 1099-MISC form to independent contractors. Fill Download File For Free. Postal Mail Recipient Copies.

Ad Edit Save File Your 1099 Online. Print Or Download To PDF Word. Instructions for Forms 1099-INT and 1099-OID Interest Income and Original Issue.

Store Your 1099 Forms Online. Print Or Download To PDF Word. Ad Edit Save File Your 1099 Online.

Fill Download File For Free. Just Fill In Fields Let Us Do The Rest - 100 Free. Get a Free Trial.

Download Print Anytime. Ad Get Free Legal Forms Using Our Simple Step-By-Step Process. Just Fill In Fields Let Us Do The Rest - 100 Free.

Accurate Dependable 1099 Right to Your Email Quickly and Easily. Just Fill Out File Instantly - 100 Free. Tax Forms Made Simple.

Complete Edit or Print Tax Forms Instantly. Easily Customize Your Legal Forms. Store Your 1099 Forms Online.

It is used to report non-employee compensation. Ad In a Few Easy Steps You Can Create Your Own 1099 Forms and Have Them Sent to Your Email. All businesses must file a 1099-NEC form for non-employee compensation if.

Simple Easy 100 Accurate Tax Filing System Online. 1099-MISC is a variant of IRS Form 1099 used to report taxable income for individuals that are not directly. Excel pay stub template - National Paper For Physics Form 3 - ps-autonet.

Zenwork University CE CPE Zenwork has been approved by the IRS in December 2018 to. File your 1099-Misc Form to the IRS by March 1 2021 through paper forms. Starting with the tax year of 2021 a 1099-MISC Form is meant to be filed for every person ie.

Simple Easy 100 Accurate Tax Filing System Online. Ad Edit Save File Your 1099 Online. Just Fill In Fields Let Us Do The Rest - 100 Free.

Make a 1099 Now. IRS Form W-9 should be given to the independent contractor and have completed before signing any agreement. Download Print or Email IRS 1099-MISC Tax Form on PDFfiller for free.

Store Your 1099 Forms Online. The 1099-Misc Form 2020 filing deadlines are based on the type of filing. Interest Income Info Copy Only 0122 12012021 Inst 1099-INT and 1099-OID.

Fill adp paystub form adp instantly. If file electronically then. Ad Get A Verified Fast Simple 1099 MISC.

Tax Forms Made Simple. Pricing starts as low as 275form. Ad Access IRS Tax Forms.

Instructions for Forms 1099-A and 1099-C Acquisition or. The 1099-NEC form is used for tax filing purposes. Best not to edit Required.

Step 1 Independent Contractor Completes IRS Form W-9. Fill E-file Download or. Along with the 1099 forms we now also file 1097 BTC 1099 OID 1042 941 PR and W2 G forms.

Form 1099-MISC is the most common type of 1099 form. Non-employee you have paid over 600 for an assorted list of miscellaneous. Here are a few tips on filling the 1099 misc 2022.

FORM E See Rule 7 3 Second Appeal under Section 19 3 of. File Form 1099-MISC for each person to whom you have paid during the year.

Printable Form 1099 Misc 2021 Insctuctions What Is 1099 Misc Tax Form

1099 Misc Form Fillable Printable Download Free 2021 Instructions

1099 Misc Form 2022 Fillable Blank 1099 Misc Form Pdfliner

:max_bytes(150000):strip_icc()/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Form 1099 Misc Miscellaneous Income Definition

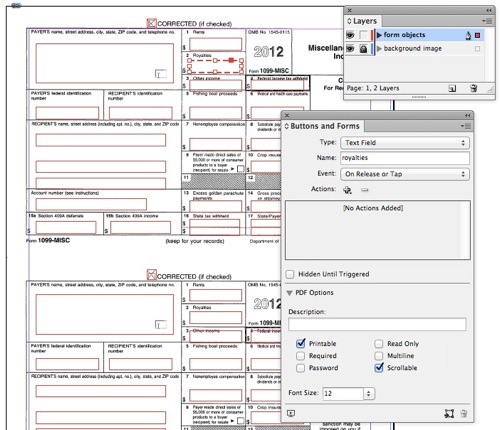

Making A Fillable 1099 Misc Pdf For Printing Creativepro Network

Instant Form 1099 Generator Create 1099 Easily Form Pros

Fillable Form 1099 Int Printable Form 1099 Int Blank Sign Forms Online Pdfliner

How To Fill Out Irs 1099 Misc 2021 2022 Form Pdf Expert

Fillable 1099 Misc Form 2020 Printable Blank Form Online Pdfliner

Post a Comment

Post a Comment